We all know how important marketing is to the success of a business.

Marketing makes lots of money for big companies, but lots of small businesses struggle with it.

Not because they don’t have the budget, but because they just don’t know what to do.

That’s where this article comes in; if you’re looking for some easy to follow advice on marketing your business, look no further than these 7 steps:

1) Make sure that people can find you.

This might seem obvious, but there are plenty of businesses out there that don’t do it.

You can set up a website and get on Google pretty easily these days, so do it.

2) Spend some time really thinking about your target market and what you’re going to sell them.

If you just decide on something quickly and change it later when you find out it’s not working then this is a waste of time.

Also, try and figure out if the thing that you want to sell them is to solve one of their problems or make their life easier in any way at all because if it doesn’t then nobody is going to buy from you regardless of how good the price is.

Once again, this might feel obvious, but I’ve seen plenty of businesses that start this way and it’s a terrible idea.

3) Give them discounts.

Once you’ve made sure that people know where to find you, make sure they know what it’s worth to them too.

If the product/service is solving one of their problems or making their lives easier then there should be some sort of reward for buying it from you instead of searching elsewhere.

4) You need to figure out how much your product/service will cost you to provide, and then work out how much profit you want to make on each sale.

This is going to determine how much money you’re going to spend on marketing because regardless of whether it’s free or not if nobody has heard about your business somehow then it’s not going to work.

5) What we’ve covered so far is the pre-marketing of your business, and that’s really important because you can get started straight away with it.

Now I’m going to get into the bare bones of how you get people to hear about who you are and hopefully buy from you.

Once you’ve got the ball rolling it’s time to keep it going.

You need to keep making new content so that Google keeps ranking your business page higher than competitors, which should hopefully translate to more customers.

There are lots of ways to do this too; video reviews, blogging about your industry, or telling stories on social media will all help you get heard, additional hints.

When somebody does buy from you make sure that they’re satisfied with their purchase and become a loyal customer by offering great service after the sale.

Also, make sure that they know how grateful you are for them buying something from you!

6) Identify where all of your potential customers spend their time online; website listings, forums, Twitter etcetera and then try and find them there.

This will be a lot easier than trying to send everyone everywhere at once so don’t be afraid to keep working on this until it’s worked out too because it’ll pay off in the long run.

7) Make sure that you maintain all of these things and keep them up to date because if you stop for too long then everything falls down around you.

I hope you find it useful.

Happy marketing!…

Using a decoy while hunting is a idea that has been around for an extremely long time. But in the 1800s what we know think of as being a decoy began to become more popular as the need to earn a living became a driving factor for a huge number of people and many of them turned to hunting to provide that income. For their hunting to be successful the hunters needed every advantage they could have and so was born what we know think of as Old duck decoys.

Many of the first decoys made were very simple in their construction. Many were nothing more than crudely carved hunks of wood with a head like attachment that had been painted in dull colors. The wood needed to be dull because ducks were found to be almost suspicious of anything too brightly colored in the water when they flew over or came into land.

Although decoys were produced in large numbers in the 1800s and posted out across the country, a just as large quantity of decoys were hand produced by the hunters that used them themselves. Decoys are used to bring the ducks into land near the edges of bodies of water, making them easier to aim at. Although shooting was the most effective method, the use of bows and arrows was also an efficient method of shooting. However using a bow needed the ducks to be nearer to the hunter.

Many of the old decoys made from the traditional wood were broken or sold for horribly small sums of wood when decoys produced from plastic started to become more popular. Because they were made from wood, the old fashioned decoys were a lot heavier and were hard to carry around in the bigger numbers that were often required.

Decoys can be linked to geographical area by the manner in which they have been carved and with the species of ducks they have been produced to represent. In harder times when hunters were forced through lack of funds to carve their own, they often copied the decoys that were already in use in their area or tried to mimic the birds they had first hand knowledge of from their own hunting experiences.

As old duck decoys become harder to find, especially those made from traditional wood, they have started to become more valuable. Those that exhibit quality craftsmanship only add to their potential value. A decoy that has been made to have a hollow body is also quite valuable as these were considered to be a challenge to make although they were very popular with hunters. A decoy in reasonable condition with a good amount of age to it is becoming harder to come across and this only adds to the value even more. Because decoys have become collectible many decoys are being kept in families and handed down from one generation to the next.

For some, decoys that have been constructed from white cedar are thought to be some of the better decoys to have. White cedar is a wood that has been found to last a good length of time and floats better in the water. The wood does not deteriorate as quickly as some other woods and when painted, it keeps its paint extremely well.

Looking to find the most comprehensive information on Old duck decoys?…

Those who are able to achieve higher yields on their investments typically don’t have a broker and don’t listen to the advice of a financial planner. After all, if either of them knew what they were talking about they wouldn’t be hustling others into allowing them to learn the trade game off of other people’s money.

The reality is the few that have gained a comprehension for seeking out and getting involved with trades that open the floodgates to massive profits use their own money and operate as part of a small, tight knit group. The members of this ‘group’ always have their feelers out like tentacles sucking up and analyzing potential transactions, immediately looking for strategic elements and immediately dumping 99% as they don’t meet the criteria.

Two major components that professional investors who use their own money and are able to consistently pick winning transactions are companies that are in merger and/or acquisition mode and companies that are seeking seed capital specifically to go public.

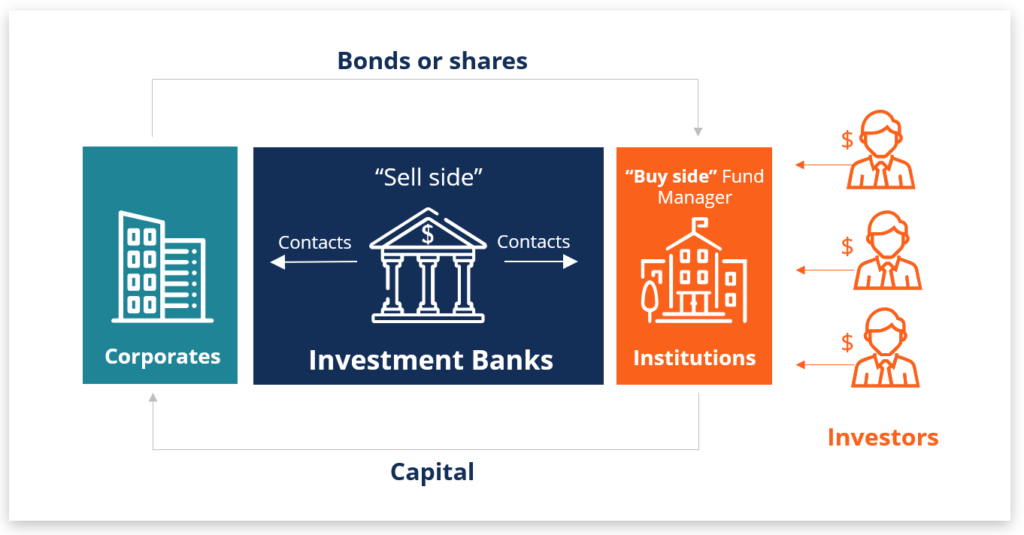

Let’s focus on the latter. Companies seeking seed capital to go public are often financially viable companies with modest liquidity but are taking on seed investors so that they can meet the SEC minimum criteria of having 40 investors on the books to qualify for going public. Investors that are able to, literally, make millions per transaction have a way of getting into these opportunities by connecting with consultants who take companies public.

If you are able to get involved with these consulting firms and if you have some capital to designate as a seed investor, you can literally be placed in 4,5 or even 6+ pre IPO investments per year. When you are one of the 40 investors in a pre public OTCBB corporation you are usually investing seed capital at a fraction of the future public price by way of DPO (Direct Public Offering). The difference between what you pay for the seed stock and what the company charges per share when public is the profit.

It isn’t at all out of the ordinary to buy seed stock at 50 cents and have that stock gain in value of $1.00 to $1.50 when the company goes public and yes, you just made 50 cents to $1.00 net profit on each share. The great thing is you can often invest as a seed investor with as little as $5,000 to $10,000. If you have more capital you can spread it out over multiple pre-IPO opportunities. Seek out the pre- public companies and make a fortune!

For Corporate Turnaround Services or Take Your Company Public, call Princeton Corporate Solutions at 267-233-0183Take Your Company Public the easy way!…